Navigating 2026 Medicare Part D Subsidies: A Beneficiary Guide

The 2026 Medicare Part D changes will introduce significant adjustments to prescription drug costs and low-income subsidies, requiring beneficiaries to understand new out-of-pocket spending limits and eligibility criteria.

As we approach 2026, understanding the upcoming modifications to Medicare Part D is crucial for millions of Americans. These changes, particularly concerning new prescription drug subsidies, are designed to reshape how beneficiaries manage their out-of-pocket costs. For many, these adjustments will bring welcome relief, while others may need to re-evaluate their current plans. This comprehensive guide will help you in navigating 2026 Medicare Part D changes, ensuring you are well-informed and prepared for what lies ahead.

understanding the inflation reduction act’s impact on part d

The Inflation Reduction Act (IRA) of 2022 is the driving force behind many of the significant changes coming to Medicare Part D in 2026. This landmark legislation aims to lower prescription drug costs for seniors and individuals with disabilities by empowering Medicare to negotiate drug prices and implementing a series of reforms to the Part D program. These reforms are not just minor tweaks; they represent a fundamental restructuring of how drug costs are shared between beneficiaries, plans, and the government.

The core objective of the IRA’s provisions for Part D is to enhance affordability and predictability in prescription drug spending. Historically, the burden of high drug costs has fallen heavily on beneficiaries, especially those with chronic conditions requiring expensive medications. The new framework seeks to mitigate this burden by introducing caps on out-of-pocket spending and expanding eligibility for financial assistance.

key provisions of the IRA affecting part d

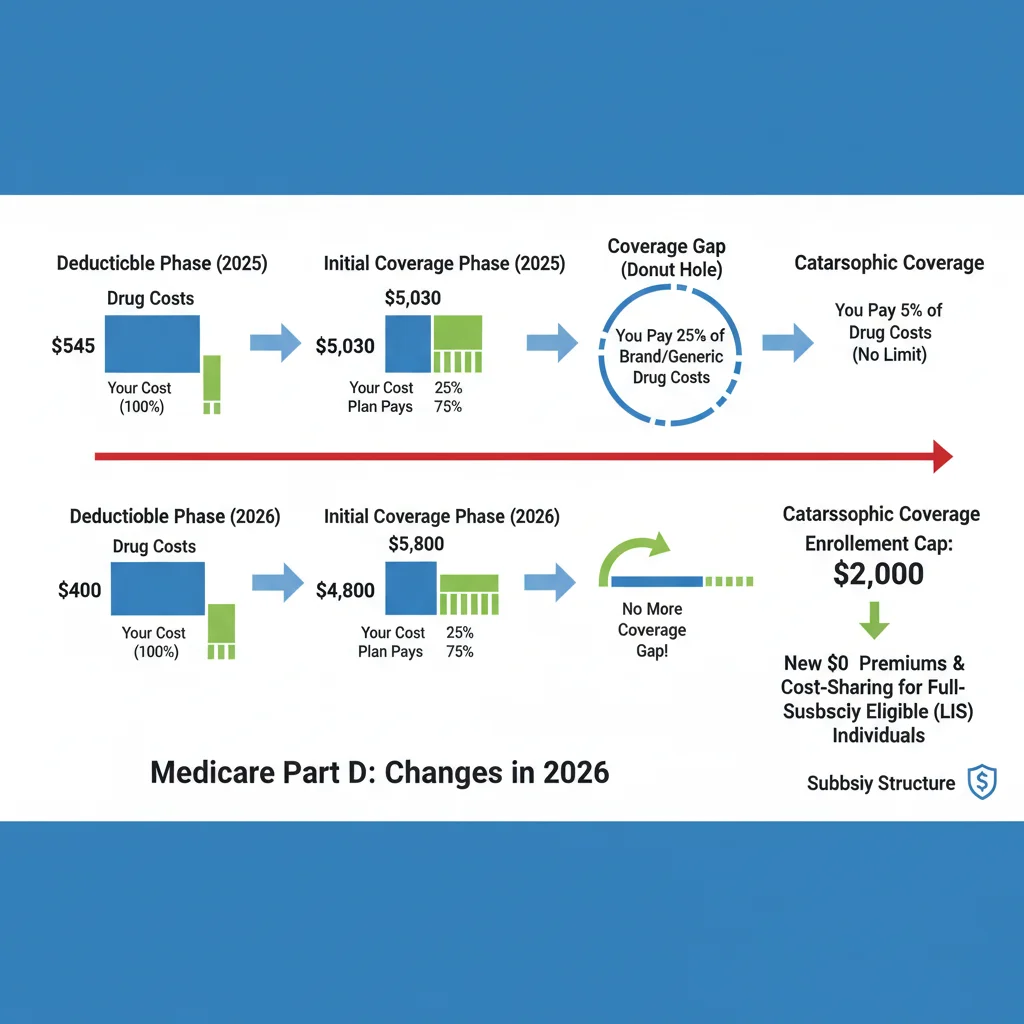

- Out-of-Pocket Cap: A significant change is the introduction of a $2,000 annual cap on out-of-pocket prescription drug costs for all Part D beneficiaries, starting in 2025. This cap will provide a crucial safety net for those with high drug expenses.

- Elimination of the Coverage Gap: While the coverage gap, or “donut hole,” has been steadily closing, the IRA further streamlines the benefit structure, effectively eliminating the beneficiary’s responsibility in the catastrophic phase.

- Drug Price Negotiation: Medicare will gain the ability to negotiate prices for certain high-cost drugs, a measure expected to lead to lower overall costs for both the program and beneficiaries over time.

These provisions are designed to work in concert, creating a more equitable and sustainable system for prescription drug coverage. The changes will not only impact individual beneficiaries but also influence the strategies of Part D plans and pharmaceutical manufacturers, potentially leading to a more competitive and cost-effective market.

the new part d low-income subsidy (LIS) program

One of the most impactful changes arriving in 2026 is the expansion and enhancement of the Low-Income Subsidy (LIS) program, often referred to as “Extra Help.” This program provides financial assistance to Medicare beneficiaries with limited income and resources to help them afford their prescription drug plan premiums, deductibles, and co-payments. The current LIS program has specific income and resource thresholds that determine eligibility and the level of subsidy received.

The Inflation Reduction Act aims to simplify and broaden access to this vital assistance. Under the new rules, more individuals will qualify for full LIS benefits, and the process for determining eligibility is intended to become less complex. This expansion is critical for ensuring that vulnerable populations can access the medications they need without facing insurmountable financial barriers.

expanded eligibility and full benefits

Starting in 2024, the IRA expanded eligibility for full LIS benefits to individuals with incomes up to 150% of the federal poverty level (FPL), eliminating the partial subsidy tier. This means that if your income falls within this range and you meet the resource limits, you will receive maximum assistance with your Part D costs, including no deductible, reduced premiums, and minimal co-payments for covered drugs. This simplification removes the previous tiered system, which could be confusing and sometimes left beneficiaries with significant out-of-pocket costs even with assistance.

- Income Thresholds: The income limits for full LIS benefits will be standardized to 150% of the FPL, making it easier for beneficiaries to determine their eligibility.

- Resource Limits: While resource limits still apply, the expansion of full benefits means a greater number of individuals who previously qualified for partial LIS will now receive full support.

- Reduced Cost-Sharing: Beneficiaries receiving full LIS will experience significantly lower or no deductibles, premiums, and co-payments for their prescription medications.

This streamlined approach to LIS is a game-changer for many, offering greater financial security and peace of mind regarding prescription drug expenses. It underscores Medicare’s commitment to ensuring essential medications are accessible to all beneficiaries, regardless of their economic situation.

impact on current beneficiaries and future enrollees

The changes slated for 2026 will have a varied impact on both current Medicare Part D beneficiaries and those planning to enroll in the future. For existing beneficiaries, understanding how these reforms intersect with their current plan and financial situation is paramount. Many may find themselves in a more favorable position, especially those who previously faced high out-of-pocket costs or were on the cusp of LIS eligibility.

Future enrollees, particularly those newly aging into Medicare or becoming eligible for disability benefits, will enter a Part D landscape that is fundamentally different from previous years. The new structure, with its out-of-pocket cap and expanded LIS, aims to provide a more predictable and affordable experience from the outset. However, it will still require careful consideration of plan choices and a thorough understanding of their benefits.

what current beneficiaries should consider

- Reviewing Current Plans: It is essential for current beneficiaries to review their existing Part D plans and compare them against the new framework. Plans may adjust their offerings in response to the IRA, and what was once the best option might not remain so.

- LIS Re-evaluation: If your income and resources are close to the LIS thresholds, re-evaluate your eligibility under the expanded criteria. You might now qualify for full subsidies, leading to substantial savings.

- Tracking Out-of-Pocket Spending: While the $2,000 cap is a welcome change, beneficiaries should still actively track their prescription drug spending to ensure they are on track and understand when they will reach the limit.

For future enrollees, the focus will be on understanding the new benefit structure from the ground up. The elimination of the catastrophic phase and the out-of-pocket cap simplify the benefit design considerably, but choosing the right plan that covers your specific medications at the best cost will remain a critical decision. The availability of enhanced LIS benefits will also be a key factor for those with limited incomes.

strategies for managing prescription drug costs in 2026

With the significant changes coming to Medicare Part D in 2026, beneficiaries have an opportunity to proactively manage their prescription drug costs more effectively than ever before. While the new out-of-pocket cap and expanded Low-Income Subsidies (LIS) provide a stronger safety net, informed decision-making and strategic planning remain crucial. Understanding your options and taking specific steps can lead to substantial savings and better health outcomes.

The goal is not just to react to the changes but to leverage them to your advantage. This involves a combination of annual plan review, active communication with healthcare providers, and exploring all available assistance programs. The landscape of prescription drug coverage is complex, but with the right approach, it can be navigated successfully.

proactive steps for cost management

- Annual Plan Comparison: Even with the new cap, Part D plans will still vary significantly in premiums, deductibles, and formulary coverage. Utilize Medicare’s Plan Finder tool annually during the Open Enrollment Period (October 15 – December 7) to compare plans and ensure your chosen plan offers the best value for your specific medications.

- Generic and Preferred Drug Utilization: Always inquire about generic alternatives or preferred brand-name drugs on your plan’s formulary. These often come with lower co-payments and can help you stay within your budget.

- Physician Consultation: Discuss your medication costs with your doctor. They may be able to prescribe equally effective, lower-cost alternatives or help you explore patient assistance programs offered by pharmaceutical manufacturers.

- Understanding LIS Eligibility: If your income or resources have changed, or if you were previously denied LIS, re-apply or check your eligibility. The expanded criteria in 2026 mean more people will qualify for full assistance.

Furthermore, consider enrolling in a Medicare Advantage Plan (Part C) that includes prescription drug coverage (MAPD). These plans often offer additional benefits and may have different cost-sharing structures that could be advantageous depending on your health needs. Regularly reviewing your healthcare needs and corresponding plan benefits is the cornerstone of effective cost management.

understanding the $2,000 out-of-pocket cap

One of the most anticipated and beneficial changes for Medicare Part D beneficiaries, starting in 2025, is the implementation of a $2,000 annual out-of-pocket spending cap. This cap represents a monumental shift in how prescription drug costs are managed, offering unprecedented financial protection against catastrophic drug expenses. Prior to this, beneficiaries in the catastrophic phase had to pay 5% of their drug costs, with no upper limit, which could lead to tens of thousands of dollars in annual spending for those on very expensive medications.

The $2,000 cap means that once a beneficiary’s out-of-pocket costs for covered prescription drugs reach this threshold within a calendar year, they will pay nothing for any further covered drugs for the remainder of that year. This includes deductibles, co-payments, and co-insurance. This provision is particularly impactful for beneficiaries with chronic conditions or those requiring high-cost specialty drugs, providing predictability and peace of mind.

how the cap works and who benefits most

The $2,000 cap applies to all covered Part D drugs, regardless of the plan. It consolidates the various cost-sharing phases into a simpler model once the cap is met. This simplification means beneficiaries no longer need to worry about the complexities of the catastrophic coverage phase, as their financial responsibility effectively ends at the $2,000 mark.

- Elimination of Catastrophic Phase Coinsurance: For beneficiaries who reach the catastrophic phase, the previous 5% coinsurance will be eliminated. This is a direct benefit of the $2,000 cap.

- Predictable Spending: The cap provides a clear ceiling on annual drug costs, allowing beneficiaries to budget more effectively and reducing financial anxiety related to unexpected high medication expenses.

- Impact on High-Cost Users: Individuals taking specialty drugs or multiple brand-name medications will see the most significant financial relief, as their previous out-of-pocket expenses could easily exceed this new limit.

It’s important to note that while the cap is effective starting in 2025, beneficiaries should be aware of how their 2024 spending might set the stage for their 2025 experience. The cap will reset each calendar year, so understanding your annual drug usage and costs will remain vital for financial planning.

important dates and actions for beneficiaries

Staying informed about key dates and taking timely actions is essential for effectively navigating the 2026 Medicare Part D changes. The reforms introduced by the Inflation Reduction Act will roll out in phases, with some provisions already in effect and others approaching. Missing critical deadlines or failing to review your plan options could result in higher out-of-pocket costs or missed opportunities for financial assistance.

The Medicare Open Enrollment Period is a particularly important time each year when beneficiaries can make changes to their Part D coverage. However, with the upcoming structural shifts, it’s advisable to start thinking about these changes well in advance of the enrollment period to ensure a smooth transition.

key timelines and recommended actions

While 2026 marks the full implementation of several major changes, some provisions have already begun. For instance, the $35 cap on insulin costs and zero vaccine co-payments were implemented in 2023. The expansion of Low-Income Subsidies (LIS) to 150% of the FPL began in 2024, and the $2,000 out-of-pocket cap for all Part D beneficiaries takes effect in 2025.

- Annual Open Enrollment (October 15 – December 7): This remains the most crucial period for reviewing and changing your Part D plan. Utilize Medicare’s Plan Finder to compare options based on your current medications and anticipated needs under the new rules.

- Check LIS Eligibility: If your income or resources have changed, or if you previously didn’t qualify, re-evaluate your eligibility for Extra Help, especially with the expanded criteria.

- Consult with a Medicare Counselor: Organizations like the State Health Insurance Assistance Program (SHIP) offer free, unbiased counseling to help beneficiaries understand their options and navigate the complexities of Medicare.

- Monitor Official Medicare Communications: Stay updated with information directly from Medicare (Medicare.gov) and the Centers for Medicare & Medicaid Services (CMS) for the latest guidance and any further adjustments to the program.

Proactive engagement with these timelines and resources will empower beneficiaries to make the most informed decisions regarding their prescription drug coverage and minimize financial surprises in 2026 and beyond. Being prepared is the best defense against unexpected healthcare costs.

future outlook and ongoing advocacy for beneficiaries

The 2026 Medicare Part D changes represent a significant step forward in making prescription drugs more affordable and accessible for millions of Americans. However, the landscape of healthcare policy is ever-evolving, and ongoing advocacy remains crucial to ensure that beneficiaries’ needs continue to be met. While the Inflation Reduction Act has brought about substantial reforms, there are still areas where further improvements could be considered to enhance the program’s effectiveness and equity.

The long-term success of these reforms will depend not only on their implementation but also on continuous monitoring and adjustment based on real-world outcomes. Stakeholders, including beneficiary advocacy groups, policymakers, and healthcare providers, will play a vital role in identifying any unintended consequences and advocating for necessary refinements.

potential areas for future consideration

- Drug Price Negotiation Expansion: While Medicare is now empowered to negotiate prices for certain drugs, expanding the scope and speed of these negotiations could lead to greater savings and broader access to affordable medications.

- Addressing Formulary Gaps: Even with the out-of-pocket cap, ensuring that Part D plans offer comprehensive formularies that cover a wide range of essential medications without excessive restrictions remains an ongoing challenge.

- Simplified Enrollment and Information: Further simplifying the enrollment process and making information about Part D plans and subsidies even more accessible could benefit a broader spectrum of beneficiaries, especially those with limited digital literacy.

The journey towards truly affordable and accessible prescription drugs is continuous. The 2026 changes lay a strong foundation, but vigilance and advocacy will be necessary to build upon these reforms and ensure Medicare Part D continues to serve the best interests of its beneficiaries. Staying informed and participating in the conversation about healthcare policy is a powerful way for individuals to contribute to these ongoing efforts.

| Key Change | Brief Description |

|---|---|

| $2,000 Out-of-Pocket Cap | Limits annual out-of-pocket prescription drug costs for beneficiaries to $2,000, starting in 2025. |

| Expanded LIS Eligibility | Low-Income Subsidy (Extra Help) expands for those with incomes up to 150% FPL, offering full benefits. |

| Elimination of Catastrophic Phase Coinsurance | Beneficiaries pay $0 for covered drugs after reaching the out-of-pocket cap, removing the 5% coinsurance. |

| Drug Price Negotiation | Medicare gains power to negotiate drug prices, aiming for lower costs over time. |

frequently asked questions about 2026 medicare part d

The most significant change is the implementation of a $2,000 annual out-of-pocket spending cap for all Part D beneficiaries, starting in 2025. This means that once your out-of-pocket costs for covered prescription drugs reach $2,000 in a year, you will pay nothing further for the rest of that year.

Starting in 2024, eligibility for full LIS benefits expanded to individuals with incomes up to 150% of the federal poverty level. This eliminates the partial subsidy tier, simplifying the program and offering more comprehensive financial assistance to a larger group of low-income beneficiaries.

While the coverage gap, or “donut hole,” has been gradually closing, the reforms effectively streamline the benefit structure. With the $2,000 out-of-pocket cap and the elimination of the 5% coinsurance in the catastrophic phase, beneficiaries will no longer face the same financial burden in the coverage gap.

You should review your current Part D plan annually during Open Enrollment (Oct 15 – Dec 7) using Medicare’s Plan Finder. Also, re-evaluate your eligibility for Low-Income Subsidies, and discuss your medication costs with your doctor to explore cheaper alternatives or patient assistance programs.

Medicare’s new ability to negotiate drug prices for certain high-cost medications is expected to lead to lower overall drug costs over time. While the direct impact on individual drug prices may vary, the overall goal is to reduce the financial burden on both Medicare and beneficiaries for expensive prescription drugs.

conclusion

The comprehensive changes coming to Medicare Part D in 2026, primarily driven by the Inflation Reduction Act, mark a pivotal moment for prescription drug coverage in the United States. With the introduction of a $2,000 annual out-of-pocket cap and the expansion of the Low-Income Subsidy program, beneficiaries are poised to experience greater financial protection and predictability in their healthcare costs. These reforms aim to alleviate the burden of high drug prices, ensuring that essential medications remain accessible to those who need them most. While these changes are largely beneficial, proactive engagement—including annual plan reviews, understanding eligibility for assistance, and consulting with healthcare professionals—will be crucial for every beneficiary to maximize their benefits and navigate the evolving Medicare landscape effectively. Staying informed and taking timely action will empower you to make the most of these significant advancements in prescription drug coverage.